Whether you’re thinking of selling your home or it recently sold, you may wonder how it will affect your taxes.

Understanding a few key things about this tax scenario will help you assess what your “take home accurately” will be at the end of the day.

Capital Gains Tax

Capital gains are the essential taxes you’ll owe on your house after you’ve sold it. We can divide this into short-term and long-term gains.

If you lived in the house for a year or under, short-term gains would apply to your taxes. These taxes will be at the rate of your ordinary income tax bracket.

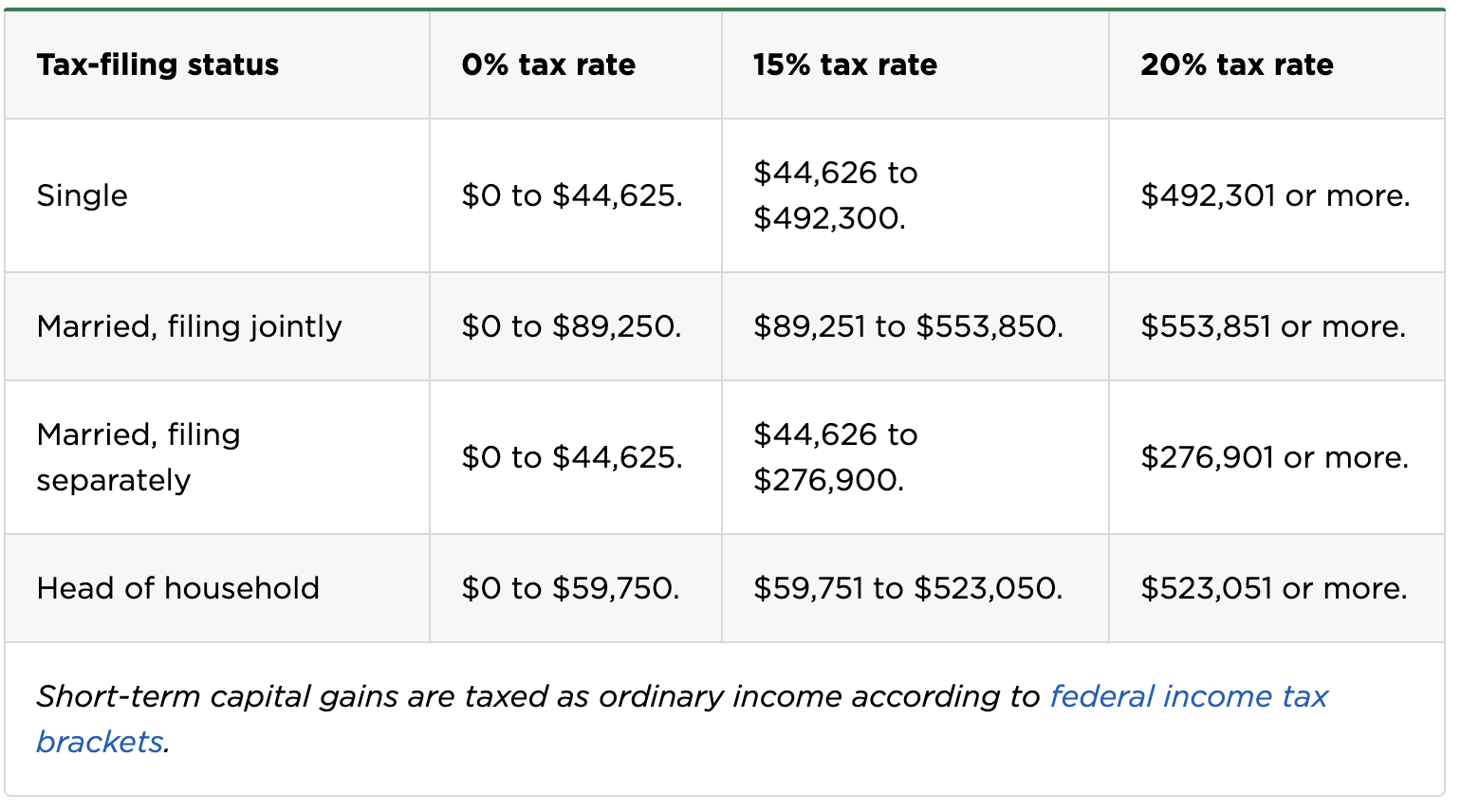

Conversely, long-term gains will apply to those who owned the sold house for over a year. The rate at which these are taxed varies. The capital gains tax rate is usually 0%, 15%, or 20%. These rates vary depending on the individual’s income and how they are filing their taxes that year.

Here are the capital gains tax rates for 2023:

How Much Taxes Will You Owe?

Now that you know the rates, you may wonder precisely how much you’ll owe. But remember, how much you owe on taxes for the house you’ve sold will depend on a couple of factors.

As we’ve covered, this includes how long you lived in the house, how much you profit from it, how you file (married and jointly vs. separate), and a few other legalities and specific scenarios.

Regarding real estate, a specific set of rules can help you estimate where you’ll end up on your taxes based on how you file.

If you file as a single person, you will be excluded from paying $250,000 of capital gains on what you profit from the sale. That number goes up to $500,000 if you file jointly. This alone will help your wallet, as you can avoid taxes on a decent chunk of the profit.

You must meet the ownership and use tests to qualify for these respective amounts. These tests simply show the IRS that you have lived in the house for the time to be eligible for the tax exclusion mentioned above and that it was your primary residence.

For your home to qualify as a primary residence, you must have owned the home for at least two years during the five years before your sale date. These two years can be at any point in the grand scheme of things and is a total summation of time lived there.

There is an exception to this rule to watch out for. If you have already claimed the exclusion ($250,000 or $500,000) in the two years before the sale of your current home, you will have to pay tax on the whole gain of the sale.

Other exceptions to the rule include specific circumstances such as buying the house in a 1031 exchange, selling the home as an expatriate (which comes with specific tax rules), and not living in the home as a primary residence. This leads us to the next aspect of taxes on a house sale; selling a second home.

Selling A Second Home Or Investment Property

If the house you’ve sold is a second home or an investment property, this will change a few things regarding your taxes.

A second home is technically considered a capital asset, which will not qualify for the exclusions mentioned above for the sale of a primary residence.

However, similarly to a primary residence, what you will pay in taxes on the sale of your second home still depends on several factors, including:

- How long have you owned the home

- How much of a profit you realize from the sale

- What you paid for the home

- Capital investments you made in the home

- Final sale price

- Filing status and income

- The applicable gains tax rate

Individuals often find ways to lower their tax burden by selling a second home. This can be done in several ways.

One common way to reduce taxes on a second home is to rent it out. By renting out your property, you can qualify for several deductions such as mortgage interest, property taxes, insurance premiums, real estate depreciation, maintenance & repairs, utilities, legal & professional fees, travel & transportation expenses, and office space.

All of these deductions take advantage of the nature of a rental or investment property, and there may be some lying around that you didn’t even realize you qualified for. Work with your financial planner to see what’s available to you should you go this route.

Another strategy is to flip the script, so your second home becomes your primary residence. This means that you lived in it most of the year (6+ months) in any given year for two out of the last five years. As we’ve covered, your primary residence will qualify for tax exclusions, which makes this (financially and literally) more valuable.

You may also utilize tax-loss harvesting, which will help offset your gains, within the restrictions of tax-loss harvesting rules (short-term capital gain can only be offset with a short-term capital loss; a long-term capital loss can only offset a long-term capital gain). These strategies can benefit you in the long run when executed correctly.

Plan Now

As you can see, there are many ways to make the numbers work on your taxes for both a primary home and a second home sale. A financial planner can walk you through the nuances of these tax scenarios.

Contact us today so our financial planners can help you plan to make the most out of the taxes on the sale of your home!