Tax season is upon us- do you know what your taxes will look like this year? Knowing what surtaxes may apply to your filings this year is essential. For some retirees, this will include the net investment income tax.

What is that? Don’t worry; we’ve got you covered- we’ll tell you what it entails and how you can manage it.

What is the Net Investment Income Tax (NIIT)?

The net investment income tax (or NIIT, found in Section 1411 of the Internal Revenue Code) went into effect on January 1, 2013, to help fund Medicare expansion. This tax applies a rate of 3.8% to certain net investment income of individuals, estates, and trusts with income above the statutory threshold amounts.

Forms of Income

Investment income tax is paid in addition to what you must pay for income tax.

For this tax, the Internal Revenue Service (IRS) designates the following as net investment income:

- Interest

- Dividends

- Capital gains

- Rental and royalty income

- Non-qualified annuities

- Income from businesses involved in trading financial instruments or commodities and businesses that are passive to the taxpayer.

The IRS states that the following are not considered net investment income:

- Wages

- Unemployment compensation

- Operating income from a nonpassive business

- Social Security Benefits

- Alimony

- Tax-exempt interest

- Self-employment income.

Fine Print

Note that the NIIT does not apply to any gain excluded from gross income for regular income tax purposes.

Gains that are included are:

- Gains from the sale of stocks, bonds, and mutual funds

- Capital gain distributions from mutual funds

- Gain from the sale of investment real estate and

- Gains from the sale of interests in partnerships and S corporations

While investment real estate is included, when it comes to the sale of a principal residence, section 121 of the tax code states that the first $250,000 (or double that for a married couple) of gain from the sale of a principal residence from gross income for regular income tax purposes is exempt from the net investment income tax.

The net investment income tax is also separate from the additional Medicare tax. You may have to pay both types of taxes, just on different types of income.

How Do I Know If I Need to Pay Net Investment Income Tax?

Now that you understand what’s included in net investment income and what isn’t, you must determine if and how it applies to you. Regarding this tax, high-income taxpayers are most likely those that need to be aware.

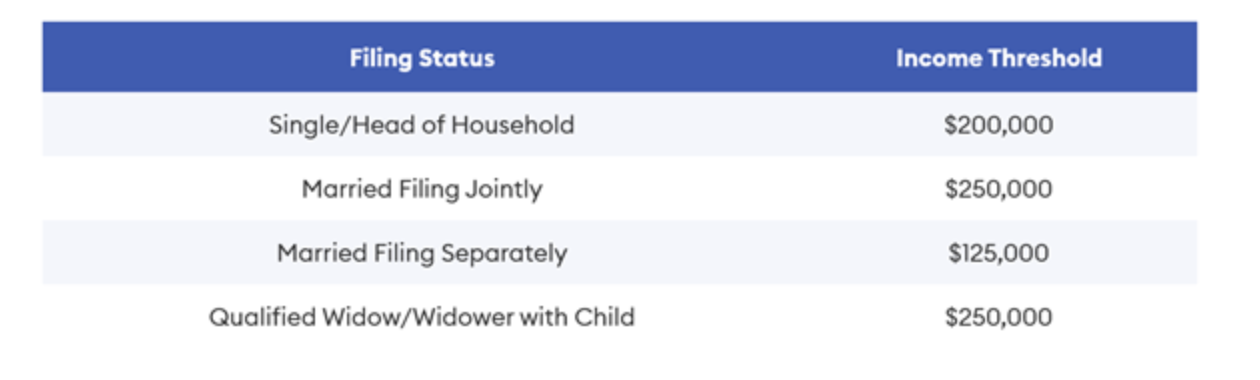

As is typical with other tax forms, the thresholds are based on your filing status (single or married) and your income.

The following chart demonstrates the thresholds for this tax:

When dealing with NIIT, you may see the acronym MAGI, which stands for modified adjusted gross income. MAGI is adjusted gross income (AGI), untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. It is often identical or very close to adjusted gross income. You are subject to paying NIIT if you have a net investment income AND your MAGI exceeds the thresholds established by the IRS.

Another way to look at it is that the net investment income tax is applied to the lesser of your net investment income or MAGI amount above the predetermined limit.

How To File

You will need to know your MAGI before filling out the net investment income tax forms. If you need to know your MAGI, you can use this worksheet. If you need to pay the net investment income tax, you’ll find the form to calculate it here, with instructions. When you report your NIIT, you will do so on IRS Form 1040.

Clever Ways to “Avoid” The Net Investment Income Tax

There are some ways to “avoid” this tax. For example, municipal and state bonds are exempt from the NIIT, so you could invest in these to help keep you below the thresholds. As for stocks, if you invest taxable investment funds into growth stocks, your gains won’t be taxed until the stocks are sold.

You can also donate your investment gains to charity. You would then deduct the value of what you gift and thus avoid the gift tax because the donation is direct to a charity.

Another option is to convert your traditional IRA accounts to a ROTH account. This is appealing because gains inside a ROTH account will be exempt from income tax and NIIT when distributions are made.

If you’re nearing the end of the year, you could sell securities with losses before the end of the year to offset any gains earned from the sale of securities.

Any techniques to reduce your MAGI will result in a reduced taxable income. Work with a professional because there can be tax consequences to “avoiding” the NIIT.

What The Net Investment Income Tax Means for Your Retirement Spending Plan

With a general idea of how the NIIT works, you can now confidently consult with your advisor to get an estimate of what the NIIT tax bill could look like for you.

Remember, this tax has some nuances, so you should strategically work with your advisor to reduce or avoid your NIIT tax bill.

We are here to help soon-to-be retirees or those already retired with all kinds of taxes, including the NIIT. Contact us today to help you make the most of your taxes this year!